What is SAP (FICO)? One of the most frequently asked questions by students and finance professionals who want to pursue a career in enterprise resource planning. What is SAP Fico And Why Does It Matter Ever since the dawn of manufacturing, it has become necessary for business industries to have accurate information regarding their production. SAP FICO is essential for the generation, analysis and validation of financial information in businesses across sectors.

SAP FICO is more than a software tool; it is also known as part of an integrated functional module within the SAP ERP system called FI (Financial Accounting and Controlling (CO). You can consider it as two significant modules in one package. While the FI module is more for external reporting and to meet financial and legal requirements, the CO module is mainly a tool for internal management, cost control, and decision support. Together, they create a “single source of truth” for a company’s financial well-being.

With companies moving to lightning speed in the SAP S/4HANA platform , the requirement for a trained individual who has finished their SAP FICO Course is at an all-time high. The blog delivers an in-depth introduction, sub-modules, and advanced features, which make this module a powerhouse for global firm management.

What is SAP FICO?

To explain what is SAP FICO, you should be able to first answer why it is used. SAP FICO enables companies to manage financial resources in an organised and legal approach. It records all of your financial transactions, and it turns the raw data into meaningful financial information.

SAP FICO: SAP FICO is 2 parts of a sleek combination. External Reporting This is the area of accounting in which the focus is on the needs of outside users. Control issues are addressed in terms of internal cost control and profitability analysis. They stay at each other’s hip and make a comprehensive financial monitoring duo.

SAP FICO is trusted by organisations from different industry types to keep their business clear, consistent and precise. That is why individuals with skills in SAP FICO continue to be in high demand and so are their careers.

Why Your Business Needs SAP FICO?

SAP FICO decisions can be taken at all levels. It provides real-time financial data. It reduces manual work. It’s an important factor in maintaining accounting standards.

The following are the primary reasons why businesses implement SAP FICO:

- It centralises financial data.

- It improves accuracy and consistency.

- It supports global accounting standards.

- It works in conjunction with other SAP modules.

- It enables faster financial closing.

It is because of these advantages that most of the learners look for what is SAP FICO course before taking a finance or ERP career.

What is SAP FICO Course?

What is SAP FICO course? is another common query among beginners. The SAP FICO course trains learners to configure, manage, and use the SAP FICO module effectively. The course covers both theoretical concepts and practical system configuration. Learners work on real-time scenarios. They understand how businesses use SAP FICO in daily operations.

A standard SAP FICO course includes:

- Basics of SAP ERP

- Financial Accounting configuration

- Controlling configuration

- Integration with other modules

- Real-world case studies

After completing the SAP FICO course, candidates can work as SAP FICO consultants, financial analysts, or SAP end users.

The Value of a SAP FICO Course in 2026

If you are looking to enter this field, enrolling in a SAP FICO course is the most effective way to gain hands-on experience. But what does a typical SAP FICO Course cover?

- System Configuration: Learning how to set up company codes, charts of accounts, and fiscal year variants.

- End-to-End Processes: Mastering the “Procure-to-Pay” (P2P) and “Order-to-Cash” (O2C) cycles.

- Integration Logic: Understanding how FICO talks to SAP MM (Materials Management) and SAP SD (Sales and Distribution).

- S/4HANA Migration: Gaining expertise in the “Universal Journal” and Fiori apps.

The what is SAP FICO coursel and scape has shifted toward “Cloud-first” learning, where students practice on live S/4HANA servers to simulate real-world business scenarios.

What is SAP FICO – Detailed Breakdown of Modules

Deep Dive: What is SAP FI (Financial Accounting)?

The SAP FI module is designed to meet the requirements of external stakeholders, such as shareholders, banks, and tax authorities. It is responsible for creating legal documents like Balance Sheets and Profit & Loss statements.

Core Sub-Modules of SAP FI:

- General Ledger (FI-GL): The vital part of SAP. All of the financial transactions from other modules are passed to GL, so users have an overall picture of their company’s financial condition.

- Accounts Payable (FI-AP): The FI-AP sub-module is a part of the finance module, and it is used to maintain Vendor transactions. It covers everything from invoice posting to automatic payment programs.

- Accounts Receivable (FI-AR): Specialised in customer management. It manages customer invoices, payments and credit memos, which helps companies maintain a positive cash flow.

- Asset Accounting (FI-AA): Assists with handling the entire lifecycle of an enterprise’s assets – from machinery, buildings, and vehicles to depreciation.

- Bank Accounting (FI-BL): Records all cash transactions and maintains master data; includes processing differentiated bank statements and clearing data.

Deep Dive: What is SAP CO (Controlling)?

While FI deals with the “What,” SAP CO deals with the “Why.” It is an internal tool used by management to understand where money is being spent and where profits are being generated. This is often referred to as the what is SAP FICO module‘s “Management Accounting” side.

Core Sub-Modules of SAP CO:

- Cost Element Accounting: Provides an overview of the costs and revenues incurred by the company based on the profit and loss statements.

- Cost Centre Accounting: Tracks the expenses of specific departments (e.g., HR, Marketing, Production) to ensure they stay within budget.

- Profit Centre Accounting: Analyses the profitability of distinct business units or product lines.

- Internal Orders: Used to monitor costs for specific, short-term projects or tasks (like a marketing campaign or a trade fair).

- Product Costing (CO-PC): A vital module for manufacturing companies to calculate the cost of producing a single unit of a product.

- Profitability Analysis (CO-PA): Helps management analyse the profit of the company by market segments, such as geographical regions or customer groups.

Key SAP FICO Features for Modern Enterprises

The SAP FICO Features have evolved significantly to include automation and predictive analytics. Here are the standout capabilities-

|

Feature |

Description |

Business Benefit |

|

Universal Journal |

Unifies FI and CO data into a single table (ACDOCA). |

Eliminates the need for manual reconciliation. |

|

Real-Time Integration |

Transactions in Logistics (MM/SD) post to Finance instantly. |

Accurate, up-to-the-minute financial reporting. |

|

Parallel Accounting |

Supports multiple accounting standards (e.g., IFRS and Local GAAP). |

Essential for multinational corporations. |

|

Automated Closing |

Uses AI to automate repetitive month-end tasks. |

Reduces closing time from weeks to days. |

|

Predictive Analytics | Uses historical data to forecast future cash flows. | Better liquidity management and risk mitigation. |

Advantages of Learning SAP FICO

Learning SAP FICO opens doors to diverse career opportunities. Finance professionals gain technical and functional expertise.

Key advantages include:

- High demand in global markets

- Competitive salaries

- Industry-wide applicability

- Strong career stability

These benefits explain why many professionals search for SAP FICO course details before enrolling.

Career After SAP FICO Course

Once you finish a SAP FICO training course, the world of finance and ERPs offers great, stable and long-term career prospects. Organisations from various industries use SAP FICO to oversee financial activities. This need results in several job opportunities for the well-trained.

1. SAP FICO Consultant

The most widely sought role after training is the SAP FI/CO Consultant. Consultants also review the business needs and set up SAP FI and CO modules as needed. They are helping to implement the software, upgrade and optimise systems. This position is ideal for individuals who are enthusiastic about problem solving client interaction.

2. SAP FICO End User

SAP FICO End Users are responsible for the daily financial activities in an organisation. Using SAP, they have basically been using posting, reporting and reconciliations. This is a good opportunity for new entrants and finance experts looking to gain system experience.

3. Financial Analyst

SAP FICO Financial Analysts use financial information to determine estimates and prepare reports. They maintain costs, revenues and profitability in SAP. Their perspectives assist the management in making more robust decisions. This position involves elements of accounting as well as analytics.

4. Accounts and Finance Executive

Most of the companies recruited Account and Finance Executives in sap fico trained persons. The SAP software is used by professionals to operate the general ledger, accounts payable, accounts receivable and asset accounting. This position provides and enhances careers for accountants who can work in an ERP environment.

5. Cost Controller

Cost Controllers only look at internal cost controlling through SAP CO. They monitor budgets, manage costs and analyse variances. This adds significant value to manufacturing and big business.

6. SAP Support Consultant

SAP Support Consultants take care of system problems and user questions. They can make sure that the SAP FICO works smoothly after implementation. This position is ideal for those who want to focus on functional support as opposed to project implementation.

7. ERP Functional Consultant

With progression, SAP FICO consultants can advance into ERP Functional Consultant jobs. They flow through to several SAP modules and drive end-to-end business processes. This position has more responsibility than and offers a clear career path.

8. Freelance and Contract Roles

How can a SAP FICO professional work as a freelancer or contract consultant? Many hire experts to work on short-term projects, system rollouts or audits. This alternative provides flexibility and increases their chance of earning more.

SAP FICO Salary Scope by Job Role

Job Role | Experience Level | Average Annual Salary (INR) |

SAP FICO Consultant | Fresher (0–1 year) | ₹3.5 – ₹6 LPA |

SAP FICO Consultant | Mid-Level (2–5 years) | ₹7 – ₹12 LPA |

|

SAP FICO Consultant |

Senior (6+ years) |

₹15 – ₹25+ LPA |

|

SAP FICO End User |

Entry-Level |

₹2.5 – ₹4.5 LPA |

|

Financial Analyst (SAP FICO) |

Entry to Mid-Level |

₹5 – ₹10 LPA |

|

Accounts & Finance Executive |

Entry to Mid-Level |

₹3 – ₹6 LPA |

|

Cost Controller (SAP CO) |

Mid-Level |

₹6 – ₹12 LPA |

|

SAP Support Consultant |

Entry to Mid-Level |

₹4 – ₹8 LPA |

|

ERP Functional Consultant |

Mid to Senior |

₹10 – ₹20+ LPA |

|

Freelance SAP FICO Consultant |

Project-Based |

₹1,500 – ₹4,000 per hour |

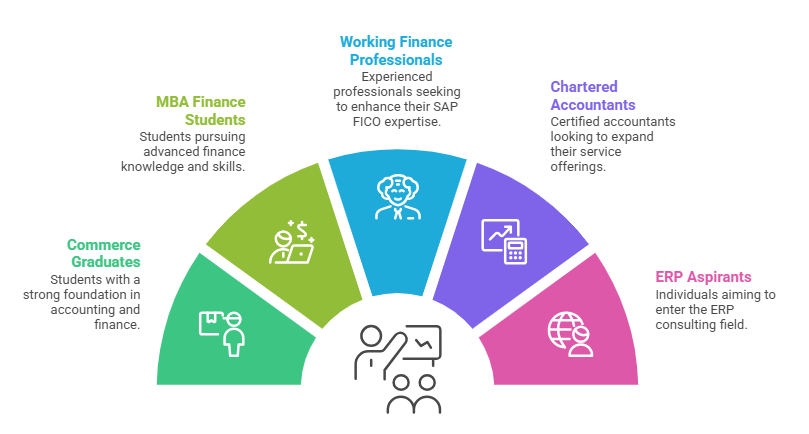

Who Should Learn SAP FICO?

SAP FICO suits a wide range of learners.

If you want to understand what is SAP FICO module and apply it in real business scenarios, this course offers strong value.

SAP FICO vs Traditional Accounting

Traditional accounting relies heavily on manual processes. SAP FICO automates these processes.

SAP FICO provides:

- Faster data processing

- Better accuracy

- Real-time insights

- Integrated reporting

This shift makes SAP FICO essential in modern enterprises.

What is SAP FICO- Learn with Eduwatts

Indeed, thebest platform to learn “what is SAP FICO” is to enrol in Eduwatt’s SAP FICO course. Eduwatts is a leading ed tech institute and offers top-notch SAP training to students across the globe. A globally recognised SAP Training Institute Eduwatts, is known for its quality education and practical-based training. Eduwatts offers a job-oriented SAP FICO Course Which is designed as per the latest demands of the market. It focuses on hands-on training in FICO modules and comes with excellent placement assistance as per your business administration career goals.

Course Details

- SAP FICO Training at Eduwatts is 100% online

- Duration is 44 hours of live training

- Moreover, you will get flexible batches

- Also learn directly from the trainers with real world expereince of more than 15 years

- Eduwatts provides recorded videos and access to an advanced LMS

- Work by doing practicals, assignments, and projects

- Curriculum is as per the industry demand

- Internship and Job assistance

- The SAP FICO course is consists of two major modules: FI (Financial Accounting) for reporting both externally and internally, and CO (Controlling) for cost management and machining.

Conclusion

Now you know in plain terms what is SAP FICO is and also what made it crucial in the current business landscape. SAP FICO unites financial accounting and controlling in a single cohesive package. It assists businesses in organising finances, controlling expenses and increasing profitability. SAP FI and SAP CO modules’organization offer accuracy, effectively unlimited transparency and full compliance. Having strong SAP FICO functionalities, such as instantaneous processing and well-oiled integrations, companies have heightened financial transparency. For aspirants who enrol in a SAP FICO training, it brings great job opportunities in various sectors. The demand for SAP and FICO professionals will not wane in the foreseeable future as businesses continue to implement ERP systems.

Recommended Reads

- Top 10 Institutes Offering SAP FICO Course in Bangalore

- SAP Consultant Salary in India

- SAP PP Module: A Comprehensive Guide

- How To Become An SAP Consultant: A Step-by-Step Guide

- SAP FICO Course Fees Breakdown Across Popular Cities

FAQs

It gets divided into FI (GL, AP/AR and AA) and CO (CC,PC,PA).

FI deals with the company’s external financial reporting and compliance CO on the other hand, manages internal planning, budgeting as well as profitability analysis

FI/CO interfaces with Sales (Chapter 12) for billing, Materials (Chapter 11) for purchasing, and Production (Chapter 10) to cost production while ensuring consistency of the entire data process.

Well, finance beginners can actually kick off their career as courses such as those by Eduwatts offer basic information on ERP and real-time IDES practice.

It grows alongside cloud, AI forecasting, Fiori dashboards and migrations fueling 2x job demand by 2027.